Market Comments |

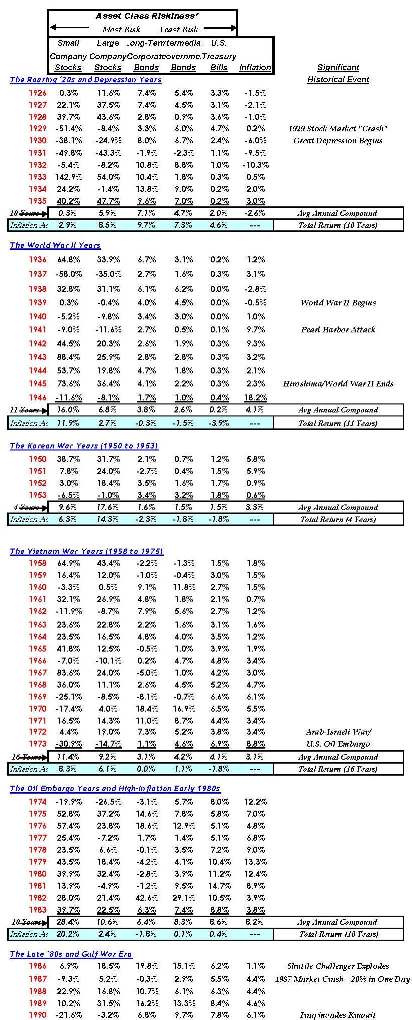

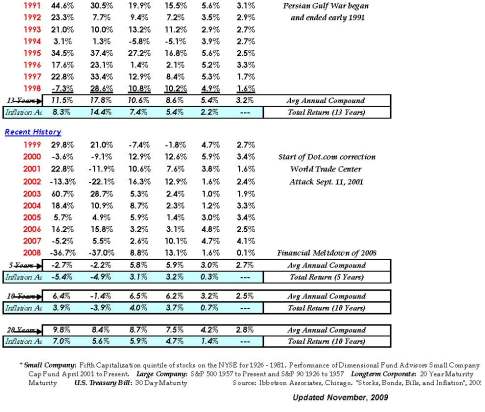

November, 2009The following information provides a helpful context for developing future return expectations for five major asset classes. Some of the most inherently difficult years economically for our country, and years in which the country experienced severe assaults upon its national "psyche" are presented below. Even after the "crash" of 1929 and the Great Depression years that followed, presented in the first category below, The Roaring '20s and Depression Years, all five asset classes experienced positive total returns. Of course, deflation was one of the overriding issues during these years and is illustrated by the negative inflation rate. Other notable periods include the World War II years, the Korean War and the Vietnam War years, the high-inflation Oil Embargo years and early 1980s, the late 1980s and first Gulf War in the early 1990s, and the most recent periods that includes the stock market bubble of the late 1990s, the horrific 9/11/01 World Trade Center attack, and the near financial collapse of 2008. From reviewing these series of difficult years and respective average annual returns associated with each, equities are undeniably volatile, and hence the most risky asset class; but equities are the only asset class to experience positive inflation-adjusted returns in all of the difficult multi-year periods highlighted below with the exception of the most recent 5 and 10 year periods. Because "reversion to the mean" can be a very powerful financial event, we believe we may be on the cusp of a rebound in exceptional equity returns. Importantly, while equity markets can be quite volatile, other asset classes are anything but static. The overriding rationale for holding equities is the extra return (or capital appreciation) derived from holding a more risky asset. Therefore, a commitment to hold equities is essential to manage through the many ups and downs of the equity markets. Seeking superior returns by "timing" the market should be avoided as research unequivocally demonstrates this to be a losers strategy for one must be right twice, and every time thereafter. Consequently, mediocre returns are all but guaranteed. Making the right decision at the right time is a difficult task, even for the most seasoned professional. Not one of the truly greats in investing, such as Warren Buffet, Peter Lynch, and John Templeton, has ever espoused market timing or been a proponent of such a strategy as they know it is the ultimate "losers" game. The overwhelming best strategy is balancing risk between the asset classes for one’s life situation and investment horizon. By successfully implementing and adhering to a long-term strategy, an investor avoids taking on more risk than the market, but still allows for participation in the equity markets and its consequent higher returns. copyright 2010 - Pflug Koory LLC

|